At Super-Advice we are about all things financial, but more importantly, helping people understand so they can get ahead financially.

We often talk about the power of having a plan and budgeting and what it’s all about is making sure that you’ve got visibility over where money is moving around in your household. It could be around in your business. It could just be yourself, could be your family, but if you don’t know, you probably find that you wonder where your money goes and it’s because you don’t know.

We’ve been asked how, how do you actually do a budget? And so I’m gonna show you today how we do it.

Step 1 Use an Excel spreadsheet

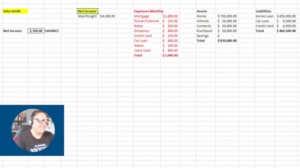

We use an Excel spreadsheet but it’s just the same as using a pen and a bit of paper, and this is how we do it. So you can see that I have organized one here for John Smith.

Let’s just highlight John there. t’s really quite simple. It doesn’t have to be complicated.

Step 2 Insert how much money you make

The first thing we need to know is how much money you make.

That is what we’ve got here, net income. And the reason we’ve got net income is that it’s more important about what money You have in your hand at payday, not what you get paid and then take the tax out.

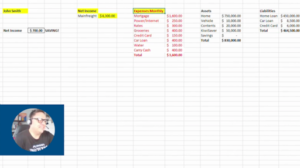

Let’s just work with what we know drops into your bank account. So we’ll say here for John, he makes a monthly income of $4,300. So that’s easy. It’s the one bit of information we need for income.

Step 3 Itemize your expenses

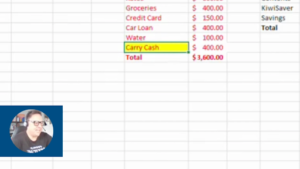

Next, we’ve got to itemise all of John’s monthly expenses. These are stock standard expenses, mortgage or rent, power internet possibly. You have to pay rates. You don’t if you rent. You have to buy food, soap, toothpaste and things like that. Groceries are an important one. If you can be disciplined with what you buy and stick to a plan, you will have more money. Most people are paying off some sort of consumer debt like a credit card, perhaps a car loan.

Step 4 Carry Cash

We want you to carry cash around. And so this is $400 for a month. You might want more than that, but this is just a generic number we are using. So a hundred bucks a week, you carry for personal spending, whether it’s lunches, whether it’s coffee with friends.

This is the money that you use!!

Step 5 Set up bills on automatic payment

Set up all of your bills on automatic payment, so they just go out. You don’t actually have to remember to pay any, these will all look after themselves.

The only money that you carry around is this carry cash. You can decide how much.

Everything here gets set up with automatic payments and you get your money out on payday. You put it in your wallet and you use cash and you stop using your debit card, and definitely don’t use a credit card.

Step 6 Stick to the plan

What we can see here is that John Smith makes $4,300 a month. All his bills, including his discretionary spending money or his carry cash, come to $3,600 per month total.

Here, he has got a surplus of $700 per month. If he sticks to this plan, you can quite clearly see that this will just grow every month and keep growing. He’s just gotta stick to the plan.

Over here, we’ve got everything that John owns, and over here, we’ve got liabilities, this is everything that John owes. This is not quite so important when doing a budget, but it’s good to know.

He owns $830,000 worth of stuff. And he’s got debts of around $460,000, so he’s in the front there. That’s a good place to be

It’s that simple, get that happening and into a routine and you also will start saving it’s as easy as that.

That’s a wrap

At Super- Advice, we offer a financial wellness program, reach out and get in contact with us and we will be happy to talk to you about it.

If you need any financial help or advice please get in touch with us at Super-Advice.